How to Track Fleet Mileage

8 min read

The average delivery truck gets only slightly better mileage than a school bus and drives more than 12,000 miles every year. If fleet managers aren’t staying on top of the vehicle fuel efficiency or the length of delivery routes, rising gas prices can quickly eat up budgets. There are many other factors that can impact the efficiency of a fleet as well. The best way to identify what those factors are and how they’re impacting the fleet is by paying attention to mileage. This makes knowing how to track mileage vital for efficient transportation.

Jump to the section you’re most interested in:

- 4 Reasons Why You Need to Track Mileage for Your Fleet

- IRS Rules for Deducting Driving Expenses

- How to Track Gas Mileage Manually

- A Better Option: Use a Fleet Management App That Also Tracks Mileage

- OptimoRoute: The Ultimate Tool for Fleet Managers

- FAQs About How to Track Mileage

4 Reasons Why You Need to Track Mileage for Your Fleet

Mileage tracking is a good record-keeping practice for all businesses that rely on vehicles for transportation. Beyond keeping accurate records, tracking your total mileage comes with other benefits that can help you save money and improve operational efficiency.

Reduce mileage

Keeping your mileage low improves fuel efficiency and minimizes wear and tear on your vehicles. But you can’t guarantee your vehicles get low mileage if you aren’t monitoring it. Tracking how many miles you drive and how much fuel it takes provides a record of a given vehicle’s driving history. If mileage decreases per gallon, it’s a clear sign that your vehicle’s fuel efficiency is declining, which is usually a result of a vehicle getting older. You can’t reverse time to stop your vehicles from aging, but you can stay on top of their mileage and keep it low.

The best way to see if a vehicle’s mileage is high is by consulting the owner’s manual. The manual will provide a manufacturer’s estimate for what the vehicle’s best mileage is, and it can be compared to the vehicle’s actual mileage. There are a couple of ways fleet managers can reduce the mileage of vehicles that aren’t seeing the fuel efficiency they should. The best way for delivery trucks to reduce mileage is to improve delivery practices by optimizing routes.

Track driver performance

Tracking mileage can even reveal insights about individual driver performance. For example, seeing a record of how far a vehicle drives helps managers see if drivers are going the full distance of the planned route or if their mileage indicates they’ve been making extra stops. This kind of insight can be helpful for fleet managers who can’t spend time in the front seat with their drivers to see how things are going.

Top-performing drivers can also reduce gas mileage by adjusting their driving techniques. Some ways that drivers can improve mileage include reducing the vehicle’s payload capacity, accelerating slowly, and avoiding roads with a lot of stop-and-go traffic. Managers can see how effectively drivers are implementing these changes by reviewing breadcrumbs from the route or by tracking mileage.

Qualify for tax deductions

Deductions are a type of tax write-off that helps businesses minimize operating costs by lowering taxable income. So, when it comes time to file taxes at the end of the year, the more deductions you have, the less taxes you’ll have to pay, and the better your tax return could be. If you rely on vehicles for transportation, then your business miles count as a deduction. But the IRS requires businesses to keep thorough records to avoid tax fraud. So if you don’t track your mileage, then you won’t be able to count it as a deduction.

Optimize operations

A good mileage log will contain other details in addition to mileage, such as the vehicle’s service history. By looking at the full history of a vehicle, managers can identify insights that can help them improve operations.

For example, say a fleet manager notices that the fleet’s mileage has increased drastically over the last three months and that the vehicles are also needing more frequent tune-ups. After looking at the driving history, the manager then notices that the mileage increase is a result of an increase in stops. The increase in stops may be the result of a boom in sales, which means it’s time to expand your fleet, so you aren’t overworking your drivers or your trucks.

IRS Rules for Deducting Driving Expenses

Filing federal income taxes is “very or moderately burdensome,” according to 77% of small business owners. That’s because it places an administrative burden on business operations. Every dollar that a business pays to the IRS after filing eats into profits. Businesses can minimize the impacts of tax season by including vehicle deductions when they file taxes. The IRS accepts two types of vehicle expense deductions: business mileage and expenses.

IRS standard mileage allowance

The IRS’ standard mileage rate is $0.58 for every mile your fleet drives. This means that if your vehicles drive the annual average of 12,000 miles, that deduction amounts to more than $6,000 a year for just one of the vehicles in your fleet. To claim this standard mileage deduction, businesses need to keep a thorough record of fleet mileage, which includes details like how many miles every vehicle drove and where they made stops during the tax period. Businesses should be prepared to provide a copy of this record to the IRS when they file their taxes.

Tracking by expenses

Mileage isn’t the only vehicle-related deduction that the IRS accepts. It also allows businesses to deduct other costs that are considered to be operating costs. A few of the vehicle deductions that the IRS accepts include the costs to own and operate a vehicle. Some of those business expenses might include:

- Auto lease payments

- Vehicle insurance

- Vehicle registration fees

- Parking fees and tolls

- Tires and general maintenance

If businesses want to deduct these car expenses from their taxes, then they should keep detailed records, including receipts that prove the costs are equal to what you claim when you file.

How to Track Gas Mileage Manually

Organizations can calculate mileage for their delivery trucks by dividing the total number of miles traveled in a given time period by the number of gallons of gas it took to get there. The easiest way to do this is to reset the odometer when trucks fill the tank with gas. Then, when it’s time to refill the tank, drivers can write down the miles on the odometer reading before they reset it. After filling the tank, the fuel pump will display the number of gallons that it took to completely fill the tank. The result of dividing the total number of miles by the number of gallons is mileage.

Create a logbook

Every vehicle should have a logbook that drivers can use to track mileage. Fleet managers can store a notebook in the glove box of each vehicle or create an electronic record, like an Excel spreadsheet with a unique tab for every vehicle. The logbook you create will contain all of the important details about a vehicle’s driving history, which makes it easy for business owners to find the details they need to assess fuel efficiency or deduct mileage during tax season.

Record mileage for any trip

It’s important to record mileage details for every trip a vehicle takes for your logbook to be accurate. This includes not only details for deliveries and business trips but also trips to testing centers or the mechanic. Fleet managers should train their drivers on how to enter information into the logbook correctly. To accurately track mileage, this means drivers need to record how many miles they drive in a given day. They should also write down when they stop for gas and how much gas it takes to fill the tank in the trip log.

Include basic information about the trip

For a complete record of a vehicle’s driving history, drivers will need to track other information in the logbook in addition to the mileage. This includes the basic details of the trip, like how many stops they made on the route, how long each stop was, and, if possible, how much time the vehicle spent idling. Keeping all this information in a logbook makes it easier for fleet managers to identify problems that may be contributing to high mileage. Drivers should also include details about how much it cost to fill the tank with gas, which will help managers with expense tracking.

A Better Option: Use a Fleet Management App That Also Tracks Mileage

Manual mileage tracking is possible, but the process is tedious. And removing control from fleet managers by relying on drivers to track mileage increases the chances for error in logbooks. Rather than wasting time on manual tracking, fleet managers can turn to an electronic logging device, or an all-in-one solution like OptimoRoute to automate mileage tracking.

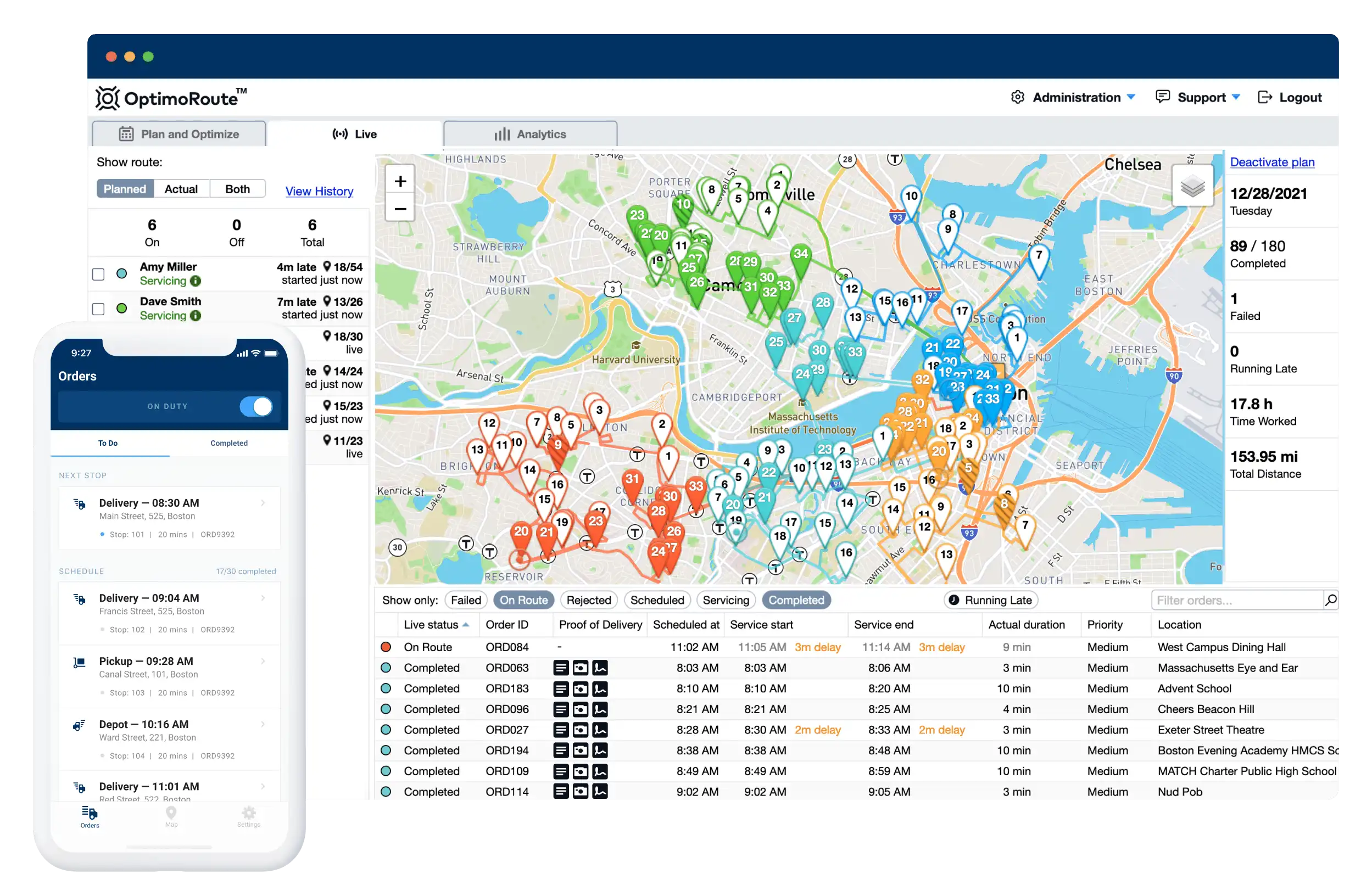

OptimoRoute is a route planning and scheduling tool that comes with robust features, including mileage tracking capabilities. The system offers a mobile app that is compatible with both iOS and Android devices. The app provides turn-by-turn directions to guide drivers to every destination on their route. OptimoRoute can use this app to access the built-in GPS and automatically track driver mileage. Managers can also calculate mileage before drivers even leave the distribution center by using the system to estimate the mileage for pre-planned routes.

OptimoRoute: The Ultimate Tool for Fleet Managers

OptimoRoute comes with other features that help fleet managers beyond mileage tracking. These include tracking that provides real-time visibility into delivery timelines, scheduling to ensure drivers are available to complete deliveries, and breadcrumbs that give organizations insights into their operations.

Live tracking and ETA

As the mobile app’s GPS collects data about drivers out on delivery, the platform updates to provide managers with visibility. This helps managers predict when drivers will arrive at their next destination. This is particularly helpful for managers back at the operations base, who may need to update customers about the status of their delivery. They can even go a step further and have text or email messages sent to customers automatically with an updated ETA and tracking link of their delivery.

Driver scheduling

The system automatically generates driver schedules that are naturally optimized to align the schedules to meet delivery demand. OptimoRoute accounts for factors like the best shift start time, driver availability, and how many deliveries need to be completed. The system can also accommodate breaks to ensure schedules and routes comply with local labor regulations.

Breadcrumbs

OptimoRoute’s breadcrumbs use the mobile app’s GPS to track the movements of drivers. This allows fleet managers to compare the actual route to the pre-planned route. This comparison allows managers to see how efficient the routes are and make adjustments to reduce mileage if necessary. It also helps identify staffing problems, like a driver that has too many unexplained deviations from the planned route.

Sign up for a free, 30-day trial to see how OptimoRoute can help you reduce mileage by improving routes for your fleet.

FAQs About How to Track Mileage

In this section, we’ll answer a few of the most common questions about tracking mileage.

What is the easiest way to track mileage?

The easiest way to track mileage is for fleet managers to use a tool like a route planner or mileage tracker that provides automatic mileage tracking capabilities.

Do I need to keep track of mileage for tax purposes?

Businesses are not required to track mileage for tax purposes. But the IRS allows businesses that track it to claim a mileage deduction. Businesses can also claim actual expenses they incur from the business use of the vehicle, which helps organizations save money when tax time rolls around.

Is there an app to track mileage?

There are a variety of mileage tracker apps businesses can use. For example, OptimoRoute is a route planning and mileage tracking app that automatically tracks mileage in addition to automating planning, scheduling, and reporting.

Try OptimoRoute™ for Free

No installation or credit card required